Pioneering a new era for emerging hedge fund managers

At Greenland, we provide aspiring portfolio managers with an unconventional incubation opportunity.

Ambitious managers are positioned to transform their distinct investment methodologies into successful investment businesses.

Our vision is an evolved capital ecosystem that launches, scales and sustains pioneering hedge funds.

We respect the individual and know there is no universal prescription for how to generate returns.

We're attuned to the individual needs of each manager and believe success can only be the result of keen awareness and constant evolution.

TALENT FIRST

Our foundational capital positions us to provide an exceptional incubation environment through the crucial early years of portfolio management.

We're not just capital partners – our philosophy of mutual growth goes well beyond the norm and we actively encourage the growth of our managers’ businesses.

BUSINESS CATALYSTS

We differentiate ourselves by enabling our managers to execute their specialized strategies and scale with heightened conviction.

This is accomplished by leveraging tailored, integrated and efficient risk management and analytical systems designed to enhance our portfolio managers’ investment processes.

ENHANCED CONVICTION

Recognizing the benefit of diversified capital bases and the challenges with traditional avenues for advancement, we maintain a flexible external capital partnership philosophy with our managers.

CAPITAL DIVERSIFICATION

LEADERSHIPMichael Englander

Chief Executive Officer

Managing Director | Millennium

Managing Partner | Series

Morton Wendell

Chief Financial Officer

CFO | Bishop Rock Capital

Head of Operations | Korenvaes Capital

Nan Xiao

Chief Technology Officer

Director of Engineering | Onehot Labs

Vice President | Infrastructure | Tradeweb

ORIGINSFounded by Michael Englander in 2021

Spun-out of Millennium’s emerging manager incubation business unit “Series”

Series was managed by Englander within Millennium for over 3 years

Greenland was established with preexisting management team, portfolio management teams and technology

Greenland is largely backed by long-term capital sources

Built on next-generation decentralized technology architecture

Platform positioned to support managers across equities, fixed income and quantitative strategies

CULTURE AWARENESSDeeply understanding your business and your role within it

RESPONSIBILITYOptimizing yourself to a state of sustained performance

CREATIONConstantly evolving the business and enriching your framework for generating returns

TALENTBuilding a business is a long-term endeavor that can only be achieved through a culture of personal growth that recognizes each unique individual.

We engage around what’s important to our team members and support them by offering a variety of initiatives across business mentorship, health and wellness and continued learning.

Our environment is designed to strengthen focus and build resilience, allowing our team members to maintain a clear headspace.

PORTFOLIO MANAGERS

ANALYSTS

ENGINEERS & QUANTITATIVE SPECIALISTS

Contact Us to learn more about our open positions

OUR APPROACHTALENT DEVELOPMENT:

We focus on underwriting investment aptitude and identifying managers who can become the best, even with limited experience of direct P&L responsibility. We partner with our PMs to build out strategies that best express their specialized alpha. Our goal is to create a capital ecosystem that PMs continuously leverage and want to be a part of.

STRATEGY DILIGENCE:

We take the time to do our work and understand each PM’s specialization in terms of style rather than coverage. Amplifying each PM's strengths will be the focus of future R&D, so developing awareness of the PM’s edge as well as detection of possible blind spots is the goal at this stage.

RESEARCH AND

DEVELOPMENT:

Constant, proactive, incremental strategy development focused on each PM’s specialized alpha is critical. Before live risk is taken, we work with our portfolio managers to create a clear and repeatable process for position sizing, leverage modulation and money management. We also begin to prepare for how the portfolio and business is expected to scale over time. Effective innovation needs to be an ongoing effort of constant refinement, not a reactive process that only happens in response to losses.

TECHNOLOGY TOOLS AND DATA ANALYTICS:

We believe portfolio managers will increasingly benefit from leveraging data-enabled and quantitative capabilities across their investment processes. Our team is highly focused on reducing barriers to the data PMs need to make insightful investment decisions, and our tech stack is achieving meaningful efficiency gains for the investment businesses we are incubating.

RISK MANAGEMENT AND ONGOING ENGAGEMENT:

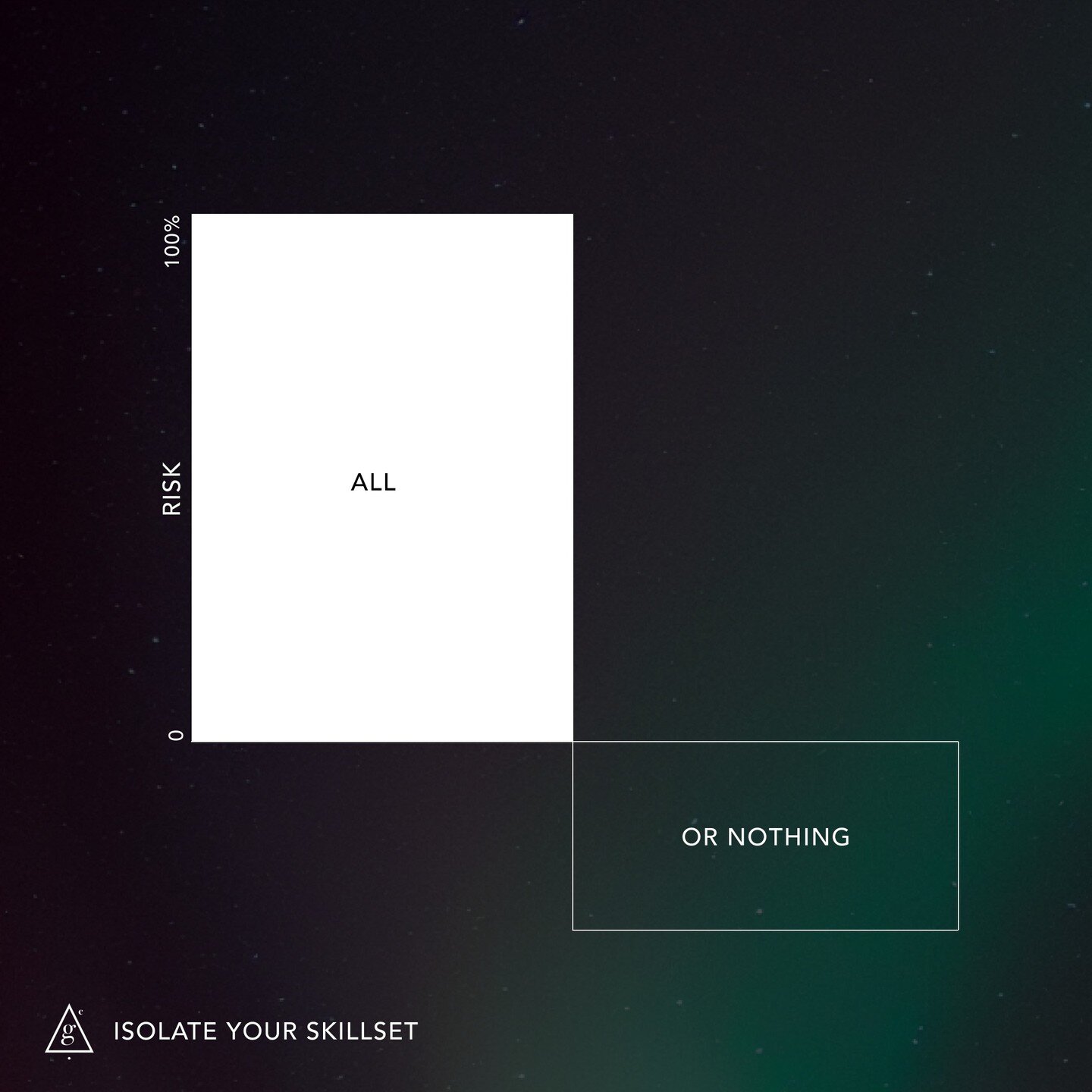

Risk limits are understood and embraced by each portfolio manager in a way that that is designed to allow their specialized alpha to flourish. Constraints are largely exposure-based, rather than statistical in nature. We actively support our PMs in exploring sensible ways to scale up underutilized capacity and grow their businesses.

*The above is a high level overview and is intended for illustrative purposes only.

PM PROCESSBuilding awareness of “specialized alpha” in the research process and systems for identifying and measuring situations / setups that leverage it.

IDEA GENERATION:

Trimming bottom-up aggregate exposures to remain within boundaries while exploring the full ranges of mutually agreed limits tailored to suit the strategy.

RISK MANAGEMENT:

POSITION SIZING:

Enhancing the connection between conviction and position sizing in a system that bottom-up governs overall deployment.

Developing systems and processes designed to amplify each PM’s style across all aspects of their business including portfolio construction, risk management and human resourcing.

BUSINESS BUILDING:

* The above is a high level overview of a complex process and is intended for illustrative purposes only. Greenland may reorder, omit, or augment the steps identified.

Greenland’s development program moves away from centralized idea/alpha capture and, instead, focuses on developing bespoke systems and processes designed to amplify each PM’s style across all aspects of their business including portfolio construction, risk management and human resourcing.

Greenland Capital Management LP

980 Madison Avenue

New York, NY 10075